Data-Driven Risk Management: The Future is Here

The era of reactive risk management waiting for a crisis to occur before formulating a response is officially over.

Read MoreFebruary 21, 2024

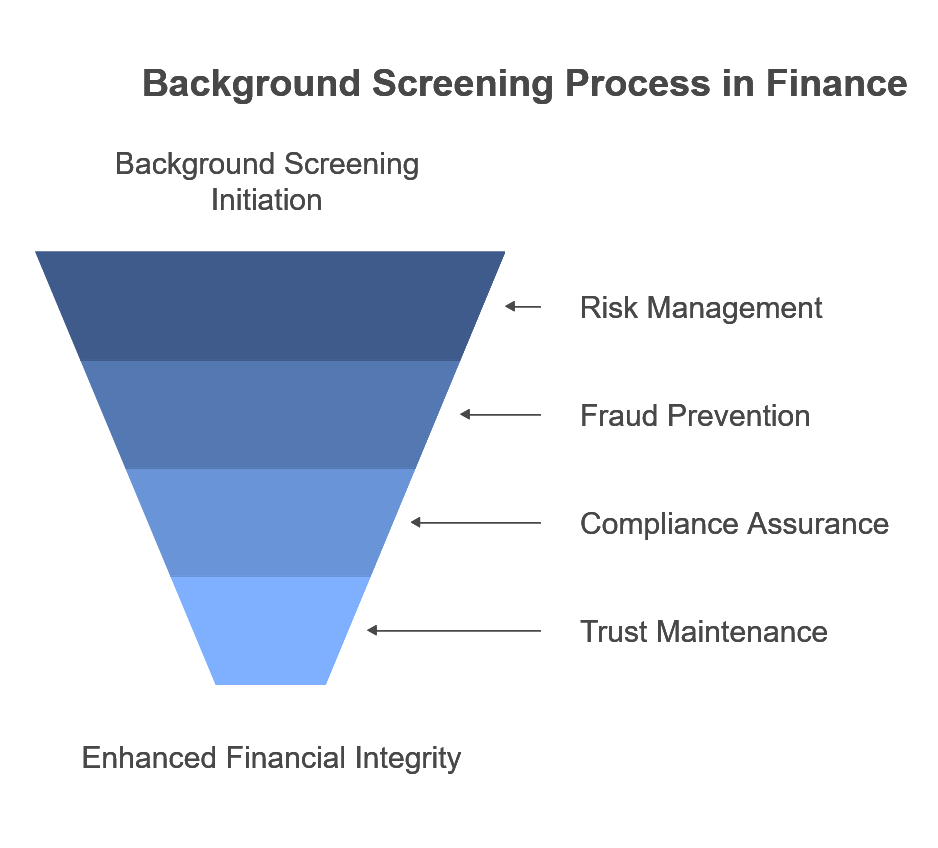

In today's fast-paced financial landscape, the integrity and security of institutions are paramount. Background screening serves as a critical tool in ensuring that organizations not only comply with regulations but also protect their assets and reputation. This document explores the multifaceted role of background screening in the financial industry, highlighting its importance in risk management, fraud prevention, and maintaining trust with clients and stakeholders.

Background screening is the process of investigating an individual's history, including their criminal record, employment history, education, and financial background. In the financial industry, this process is essential for several reasons:

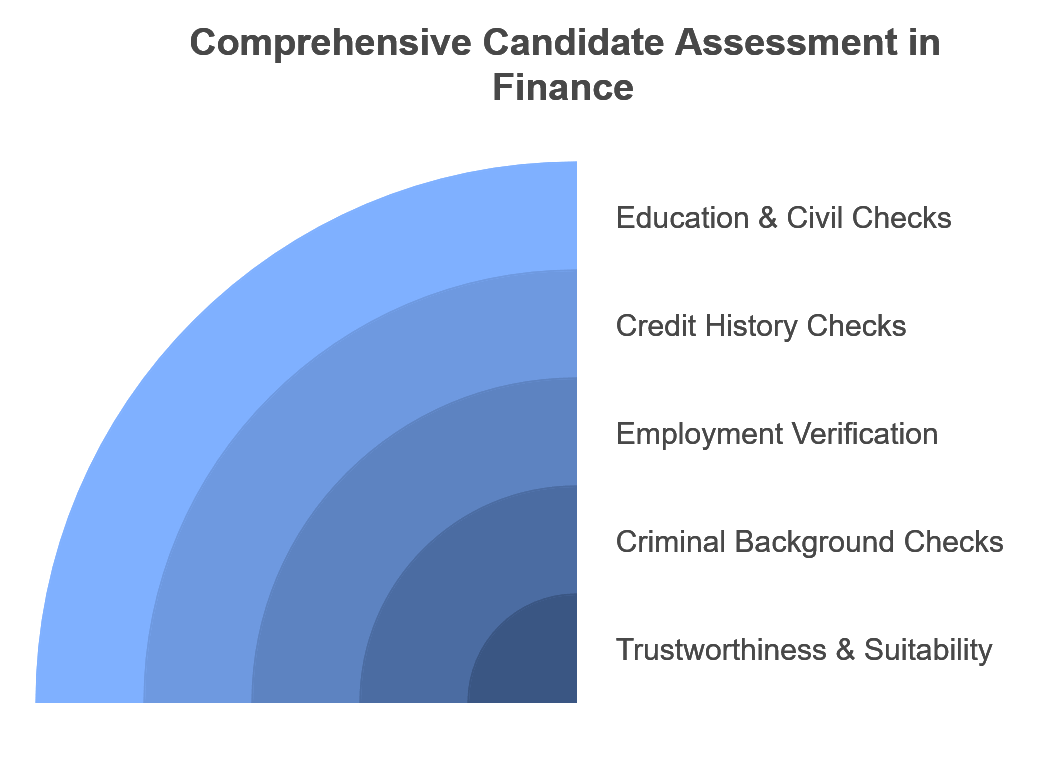

There are various types of background checks that financial institutions can implement:

![]()

Advancements in technology have transformed the background screening process. Automated systems can quickly gather and analyze data, making it easier for financial institutions to conduct thorough checks. Additionally, artificial intelligence and machine learning can help identify patterns and anomalies that may indicate potential risks.

Background screening is more than just a regulatory requirement; it is a fundamental component of risk management in the financial industry. By implementing comprehensive screening processes, financial institutions can protect themselves from fraud, ensure compliance with regulations, and maintain the trust of their clients. As the industry continues to evolve, the importance of background screening will only grow, making it an indispensable tool for safeguarding the future of finance.

Security Consulting

The era of reactive risk management waiting for a crisis to occur before formulating a response is officially over.

Read More

Security Consulting

For businesses in Nigeria and across the globe, understanding and mitigating physical risks has never been more critical.

Read More

Protective Intelligence

Should ordinary citizens take up arms to defend themselves? On the surface, it seems a simple, visceral answer to a complex problem.

Read More